The pricing of generative artificial intelligence (GenAI) applications is a hot topic. Microsoft revealed its vision for its Copilot “digital companion” last month and affirmed price points of $30 per month for enterprise customers.

But the critical question for software companies and platforms providers at this stage should not be “how much should we charge?” Instead, the question that should guide decision-making – from product development through go-to-market tactics and customer retention – should be “what is our pricing strategy?”

Our Strategic Pricing Hexagon provides the ideal touchstone for answering that question efficiently and confidently, not only for breakthrough products such as GenAI, but for any product or service. The development of pricing strategy starts with the best answers to these three questions:

- How do we create and share value?

- What pricing game best fits the characteristics of our market?

- What pricing model best supports our value creation strategy?

One challenge that providers of GenAI applications face is the high level of operating costs, as I mentioned earlier this week in an article in The Wall Street Journal.

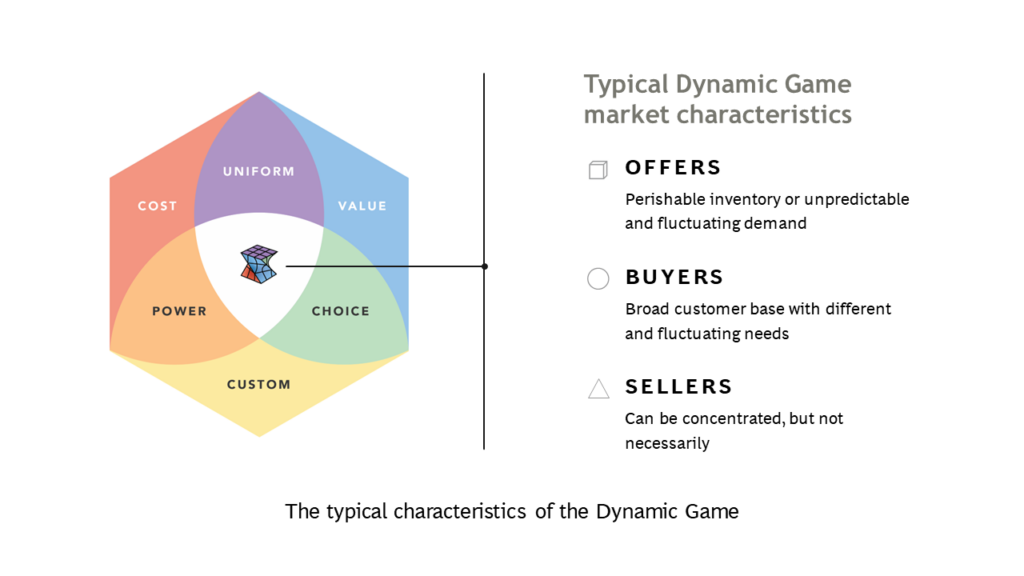

In the previous newsletters, we introduced six of the seven games in the Hexagon. In this edition, we complete the overview of the games by introducing the Dynamic Game. Its position in the center of the Hexagon is not a coincidence. In the Dynamic Game, literally everything matters. Every input and every pricing framework can influence how leaders make decisions, and each of the six market forces we describe in Game Changer can exert a push or pull on the market.

Winning the Dynamic Game

When the Houston Astros began the 2023 season in Major League Baseball, the average ticket price for a game at Minute Maid Park, their 41,000-seat stadium, was $62.56 per ticket. That reflects the face value of the tickets.

But when the Astros begin their playoff series this coming Sunday against their in-state rivals, the Texas Rangers, the cheapest tickets on the resale site, Seat Geek, would cost you $205 per ticket, and for that price you don’t even get to sit. That ticket gets you into the standing-room-only section. The most expensive seats near field level would cost over $2,900 per ticket.

Granted, that is not quite at the level of a Taylor Swift concert. Asking prices on resale sites for seats to her upcoming concerts in Miami are running as high as $5,500 per ticket.

If you decided to fly to Houston for the ball game or to Miami for the concert, book a hotel room, and then use a ride-share service to get around, you will have a full immersive experience in what we call the Dynamic Game. The prices for all of these offerings – a ticket, a flight, a ride, and a room – depend on far more than the mere laws of supply and demand. They depend on, well … just about everything that could impact someone’s purchase decision, including your own.

As shown in the figure below, companies ideally suited to the Dynamic Game tend to have adjustable capacity, perishable inventory of relatively undifferentiated products, or constantly fluctuating demand from a broad base of customers whose needs are never truly static. All major drivers of price variance – location, time, customer segment, occasion, supply and capacity, volume, and channel – affect marginal costs, customer value, and willingness-to-pay simultaneously. Competitors usually face similar pressures, which means that their pricing strategies and tactics are also valuable inputs.

The Dynamic Game, however, is more than the implementation of dynamic pricing, the approach which allows your prices to change mechanically in response to changes in the parameters you track. The Dynamic Game reflects an entire organizational approach to a market, with companies in some cases striving for individualized offers and prices set in as close to real-time as possible. Not every organization can manage that level of complexity.

The Dynamic Game may be the world’s oldest pricing game

For all its modern trappings with vast pools or real-time data and sophisticated algorithms that far exceed the processing capabilities of the human brain, the original Dynamic Game is as old as commerce itself. The primitive versions include the farmer’s market or the bazaar, where sellers rely on their intuition, experience, and the state of their inventory to adjust their visible prices and their negotiating strategies on the fly.

One important difference is that those transactions in many cases are not parts of repeated games. In the contemporary and continually evolving Dynamic Game, companies generally need to assume that they are playing a repeated game and that customer relationships matter.

Succeeding in the modern version of the Dynamic Game

The yield management programs of airlines were among the first examples of the modern Dynamic Game in action. The airlines have spent decades honing their ability to react to the complex ebbs and flows within their markets as well as to external shocks, which can range from localized events, such as an airport closure due to weather, to global events with unforeseeable consequences, such as the Covid-19 pandemic. These days, their advanced algorithms attempt to take strategic, behavioral, and financial inputs into account simultaneously, accompanied by human judgment.

The players of the Dynamic Game also actively shape the underlying dynamics of their markets by influencing customer access, adjusting their range of options, and improving efficiency. Each player makes an ongoing commitment to become smarter, faster, and fairer with the way they share value, as they gain a richer and more reliable understanding of the factors that drive buying behavior. They find themselves in a continuous loop of self-optimization, using all the inputs and economic frameworks simultaneously with a growing level of complexity.

But whenever they think they have mastered the game, it’s time to change the game. Successful players test and adjust their models continuously, using the latest data and technologies. They also stress the human factor in managing the Dynamic Game. The combination of human talent and advanced analytics delivers superior outcomes and ensures that the algorithm becomes neither a “black box” nor a rogue actor within your organization.

We recommend the Dynamic Game to companies with sophisticated pricing capabilities, even if their market characteristics don’t yet fit the game perfectly. The center of the Hex is a destination worth exploring for companies that have developed advanced pricing capabilities in one of the peripheral games.

View this edition of The Game Changer Newsletter on LinkedIn